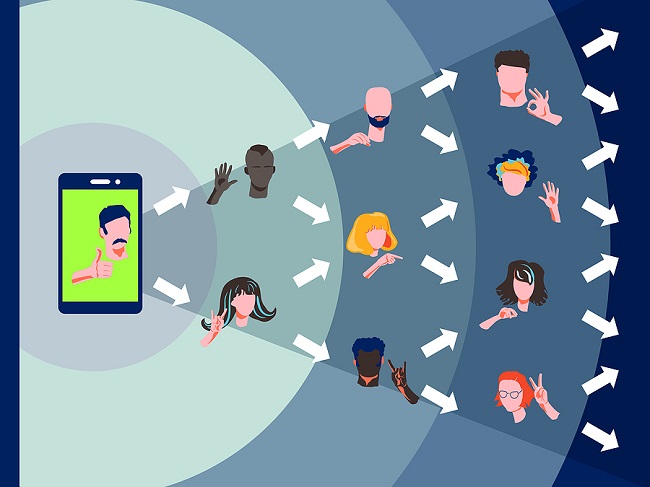

Client recommendations can be the most effective form of advertisement. You work hard to help your clients get the right coverage for their needs. Most of your clients are very happy with your services, and many of them have friends and family who may need similar assistance. If they recommend you, it’s a win-win situation.

The only question is, how do you encourage your clients to refer you?

Seeking out referrals is a smart business practice. Before you come up with a referral campaign, however, make sure you know what is permissible. CMS has strict rules on marketing practices, and agents who don’t comply may face license suspension and other penalties.

What Do the Medicare Communications and Marketing Guidelines Say?

If you have questions about marketing rules for Medicare insurance agents, the Medicare Communications and Marketing Guidelines is a good place to start.

Here’s what the guidelines say about referrals and gifts.

- You can offer nominal gifts to beneficiaries for marketing purposes.

- Gifts must be given without discrimination. For example, gifts provided at an event must be given whether or not the attendees enroll.

- The gift cannot have a value greater than $15, and the aggregate value of gifts cannot exceed $75 per person, per year.

- Instead of giving each beneficiary a small gift, you can give beneficiaries attending an event the chance to win one bigger gift, such as in a drawing. The maximum value of the gift is based on the number of beneficiaries you expect to attend. For example, if you expect 10 people to attend an event, the gift cannot have a value that exceeds $150 ($15 multiplied by 10).

- Meals cannot be given as gifts. However, refreshments and light snacks may be provided at events.

- You cannot give cash or other monetary rebates as gifts, regardless of the value.

Don’t mix these rules up with the rules covering referral fees that carriers can pay to agents. According to CMS, agents and brokers may receive a referral or finder’s fee for identifying an individual who needs coverage.

What Should Medicare Agents Do?

As a Medicare agent, you need referrals to grow your business. You also need to stay mindful of the rules so you don’t run afoul of compliance issues.

- DON’T collect phone numbers. You cannot collect phone numbers or call people based on referrals. For example, a client may try to give you the phone number of a friend who may be interested in help with Medicare coverage, but this does not give you the permission needed to contact the friend by phone. Let the person being referred contact you.

- DO provide copies of your business card. Handing out business cards is a great way to show that you would like referrals while staying compliant. It also makes it easy for your clients to pass on your contact information.

- DON’T offer large gifts or cash. When selecting gifts, remember that cash is not allowed, and the value must not exceed $15 per gift or $75 per person, per year. Use a spreadsheet to keep track of gifts so you do not go over the annual limit. These values may include sales tax, so to be safely under the $15 limit, we recommend using a $10 gift card as a referral thank you.

- DO provide gifts to say thank you – without strings attached. Gifts must be given without discrimination. To comply, do not give gifts with strings attached. Don’t say that you will give a gift in exchange for a referral.

Most importantly, provide excellent service. This is the best way to encourage referral business.