As a Medicare agent, you are all too familiar with Medicare’s coverage gap – better known as the donut hole – which affects beneficiaries with high-cost prescriptions. But there is some good news on the horizon: the Biden Administration’s Inflation Reduction Act of 2022 includes several provisions addressing the rising drug costs for Medicare beneficiaries.

- Already enacted in 2023 – The cost of insulin has been capped at $35.

- In January 2024 – Elimination of the 5% coinsurance for those who reach the catastrophic coverage phase of the Part D coverage gap.

- In January 2025 – Out-of-pocket costs for Part D prescription drugs will be capped at $2,000 each year.

- For the first time, Congress has given Medicare the power to negotiate with manufacturers to bring down the cost of high-priced drugs that treat a variety of chronic conditions, including diabetes, heart disease, cancer, and kidney disease. This will result in a gradual implementation of lower drug prices starting in 2026.

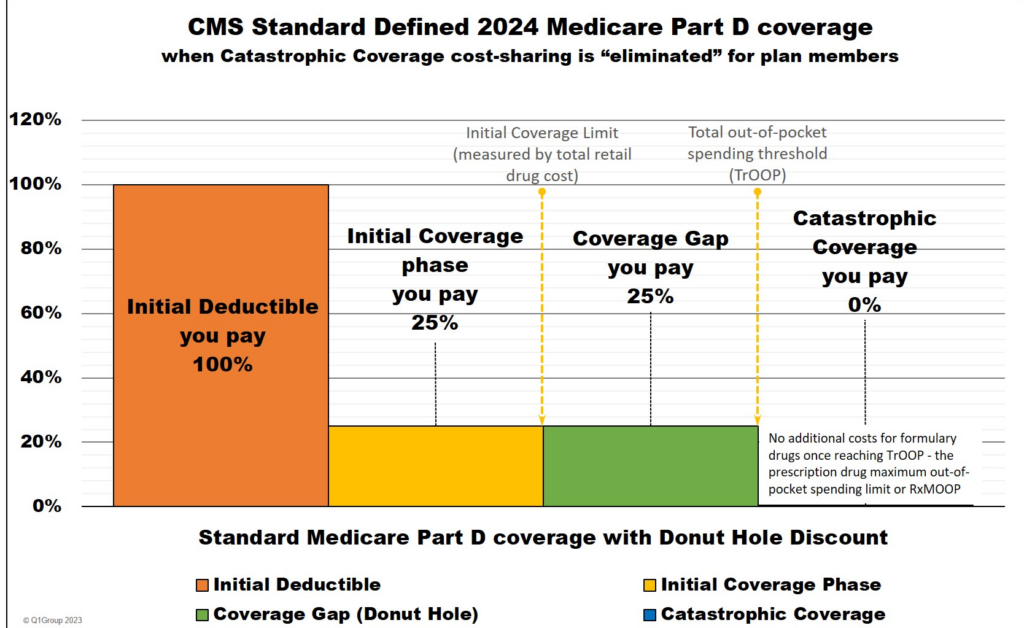

The Donut Hole in 2024

Whether beneficiaries have prescription drug coverage through a Medicare Advantage plan or a stand-alone Part D plan, the donut hole could impact their out-of-pocket costs. Depending on the types of medications they take, they may never enter the donut hole. If they do, though, there is a temporary limit on what the insurers will pay. This requires the beneficiary to pay more for a certain period of time.

It’s easier to understand the donut hole when you look at its three distinct phases:

The Initial Coverage Phase

In this phase, the beneficiary is responsible for paying any deductible. It’s important to note that not all plans have a deductible. For those that do, the deductible may only apply to some tiers of medications. After beneficiaries have met their deductibles, they are responsible for paying the copays and coinsurance, based on the tier the medication falls on. The plan’s premium does not count toward these costs.

Beneficiaries will stay in this initial coverage phase until the cost of their drugs totals $5,030 – an increase from $4,660 in 2023. At this point, beneficiaries will enter the coverage gap.

The Coverage Gap or the Donut Hole

In the coverage gap, beneficiaries are responsible for 25% of the cost of covered medications at the pharmacy (this is automatically taken at the point of sale) until their out-of-pocket costs reach $8,000 – an increase from $7,400 in 2023. At this point, beneficiaries will enter the catastrophic coverage phase.

The Catastrophic Coverage Phase

Once beneficiaries’ year-to-date out-of-pocket costs reach $8,000, they will have $0 cost for the rest of the calendar year. Previously, in this phase, beneficiaries paid 5% of the cost of the drug.

Other Important Information to Share with Your Clients

- Copays for covered insulin will remain at $35, regardless of whether beneficiaries have met their deductible. The donut hole will not impact insulin costs.

- When beneficiaries change plans mid-year, the donut hole calculations move with them – they do not start all over again.

- Part B Medications are not part of the donut hole calculation. These medications count toward out-of-pocket maximums on the medical plan.

Help Paying for Prescription Costs

Beneficiaries who need high-cost medications should talk to their doctors to see if a lower-cost drug might be an option. If they are having trouble paying for their medications, there are programs available to help. They may qualify for the Extra Help/Low Income Subsidy. In 2024, the thresholds for Extra Help will be lowered, making more people eligible for full benefits to help pay out-of-pocket expenses for prescription drugs. Some beneficiaries may also qualify for assistance from their states’ Rx Assistance Programs.

Although lower costs are good news, some of your clients may find these changes to Medicare coverage confusing. Western Asset Protection has resources to help you educate your clients. Contact us today.